According to Bloomberg Tax, Cupertino City Council weighs four tax options to fill in Apple revenue loss. The council must decide by June to make the options appear on the November 2024 ballot.

City of Cupertino published a survey for business community at here.

The four tax options are:

- A 0.25% local transaction and use tax, which would be added to the 9.125% sales tax. It would be levied on purchases made in Cupertino and allocated to the city. The city expects this tax would raise $5.4 million annually.

- An increase from 12% to 15% in the city's transient occupancy tax on lodging, which would raise $1.9 million per year.

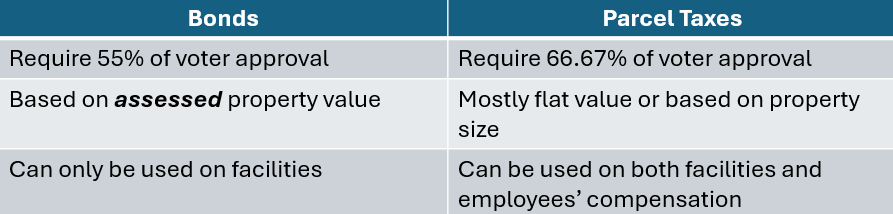

- A parcel tax levied at a flat rate or several progressive rates on homes and businesses, which would raise $3.7 million per year.

- A business operations tax levied at progressive rates based on some measurable aspect of the business operations, such as: gross receipts/payroll, number of employees, square footage of business, etc. BOT would raise $4.1 million per year.

Transaction and Use Tax is different from sales tax. Sales tax is based on Point of Sale, while TUT is based on Point of Delivery. Cupertino residents should pay TUT when they shop online since TUT applies to delivery address. Anyone shopping in Cupertino businesses also should pay the increased TUT.

Cupertino's current sales tax is 9.125%. With 0.25% hike, the new tax rate will be 9.375%. As comparison, Sunnyvale, Santa Clara, Saratoga, and Los Altos have sales tax rate at 9.125%. While sales tax in San Jose is 9.375%.

The city's survey suggested the Business Operation Tax being considered is employee head tax. Many businesses, including Apple, expressed they oppose such tax before. But that happened before Apple sales tax loss. Apple mentioned they would stop any future growth in Cupertino if employee head tax is levied.

The parcel tax applies to each home and business. It can be either flat rate or per square foot. Flat rate has more impact for individual home owners than large landlords since they would pay the same amount regardless the size of the property. The city's survey suggested flat rate Parcel Tax is being considered. Bloomberg has an article A Progressive Parcel Tax Could Solve Cupertino’s Budget Woes.

Transient Occupancy Tax applies to lodgers in Cupertino hotels. It doesn't affect residents directly, but may affect hotel business.

Below is a copy of this article on Bloomberg Tax by Laura Mahoney

Cupertino Weighs Four Tax Options to Fill in Apple Revenue Loss

December 5, 2023, 7:47 PM PST

o City council faces June deadline to decide

o Revenue loss tied to state’s review of Apple sales tax agreement

By Laura Mahoney / December 5, 2023 10:47PM ET / Bloomberg Law

Leaders in Apple Inc.'s hometown of Cupertino are considering a menu of four tax increases to make up for the loss of revenue from the company’s online sales.

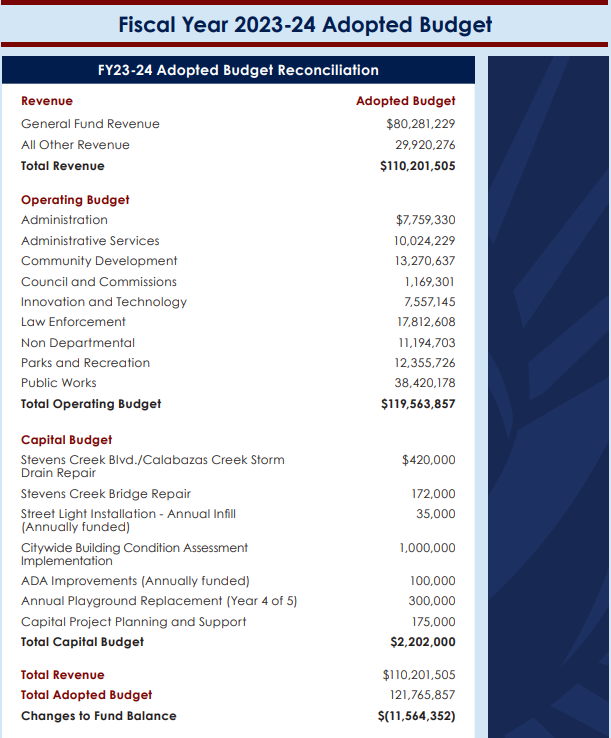

The Cupertino City Council voted 4-1 on Tuesday to direct its staff to ask businesses in the city for their input on the tax ideas and report back in January, when the council will also be considering budget cuts to help close a $15 million deficit due to the state’s actions. Next, the council could consider narrowing the options for possible placement on the November 2024 ballot after polling residents to gauge support. The council must decide by June.

The four tax options are:

• A 0.25% local transaction and use tax, which would be added to the 9.125% currently levied in Cupertino that includes statewide sales tax and six different county or regional special taxes. It would be levied on purchases made in Cupertino and allocated to the city, and would raise $5.4 million annually.

• An increase from 12% to 15% in the city’s transient occupancy tax on lodging, which would raise $1.9 million per year.

• A parcel tax levied either at a flat rate or several progressive rates on homes and businesses, which would raise $3.7 million per year.

• A business operations tax, or employee tax, levied at progressive rates based on the number of employees, which would raise $4.1 million per year.

Cupertino is facing the choices because the California Department of Tax and Fee Administration is scrutinizing whether Apple improperly designated the city as the location of online transactions for iPhones, MacBooks, Airpods, and other products sold in California. The city has an agreement with Apple to give 35 cents of every dollar to the company, and has paid Apple $107.7 million since 1998.

The council has already set aside $56.5 million to repay the department for sales tax it has received since April 2021 and expects future sales tax revenue could drop by 73%.

The city is appealing the department’s determination, but that process is expected to take months or years and could end up in state court.

Council members, who did not name Apple during the hearing, opted to ask the business community for input first instead of taking recommendations from its staff and a consulting firm that analyzed options to begin polling residents on their support for the transaction and use tax. That option, which would require a majority of voters’ approval, would keep the city’s tax rate competitive with its neighbors’ and be spread across residents, businesses, and visitors.

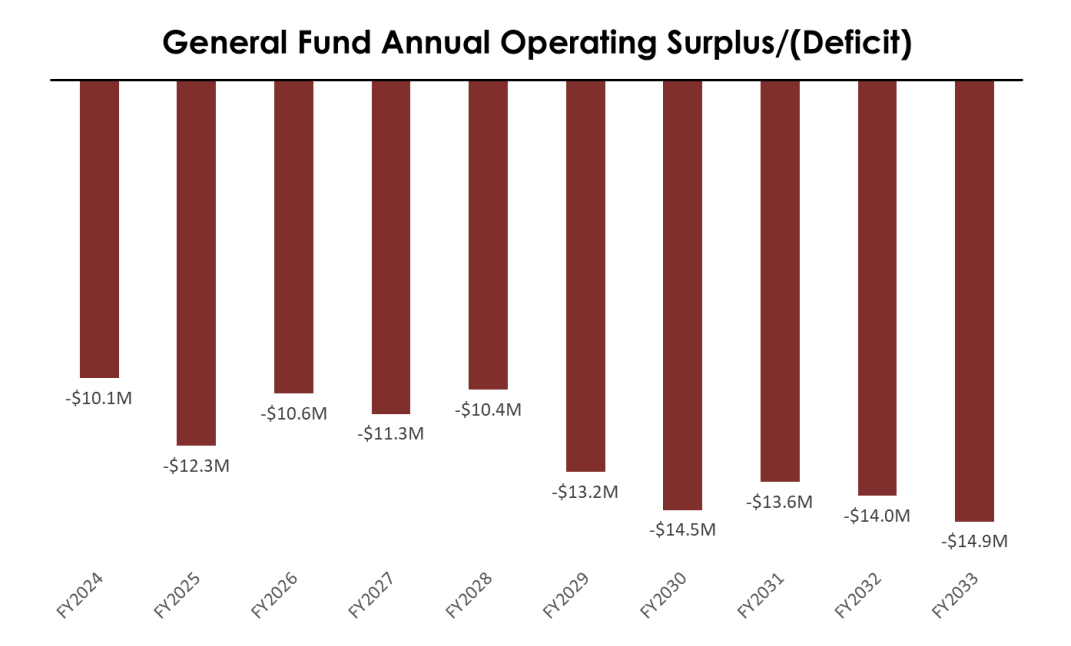

Even if the city enacts a tax increase, it will still face an annual budget shortfall of at least $10 million, said Kristina Alfaro, director of administrative services.

To contact the reporter on this story: Laura Mahoney in Sacramento, Calif. at lmahoney@bloombergindustry.com

Link to story: https://news.bloombergtax.com/daily-tax-report-state/cupertino-weighs-four-tax-options-to-fill-in-apple-revenue-loss