CUSD Bond Measure 2024

-

CUSD Board discussed a potential bond measure at the 4/25/2024 Board meeting. The list of projects can be found here.

Why bonds?

As you can see in CUSD FY2023-24 Budget, CUSD budget were spent on

- Employee Salaries and Benefits (83%)

- Books and Supplies (7%)

- Services and Operating Expenditures (9%)

- Misc expenses

Only part of "Services and Operating Expenditures" can be used for facility repairs and improvements. But that's not enough. CUSD depends on bonds for facility repairs and improvements as a "tradition".

What are current bonds?

You can find all CUSD bonds on EMMA.

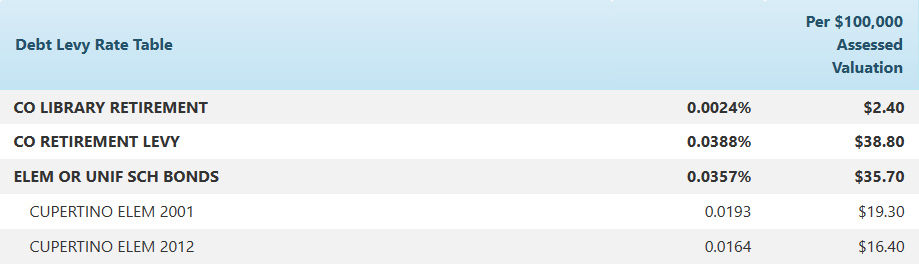

Residents are currently paying two CUSD bonds right now (you can check at Santa Clara County Tax Allocation).

The 2001 bond should be paid off in 2027.

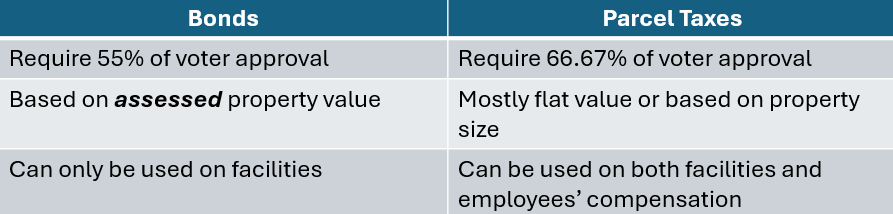

The 2012 bond (Measure H) ran out of money in FY2022-23, but will be paid off around 2040.What's the difference between bonds and parcel taxes?

Please see this article for more information.

How bonds work?

According to Bond measure at the 4/25/2024 Board meeting,

- The district raises the money (bond) in three series

- The residents pay back the bond based on assessed property value in about 30 years (probably faster since the assessed property value should increase)

- The district uses the bond money on projects (normally last shorter than payback time, previous 2001 and 2012 bonds lasted around 10 years each)

The Official Bond Measure:

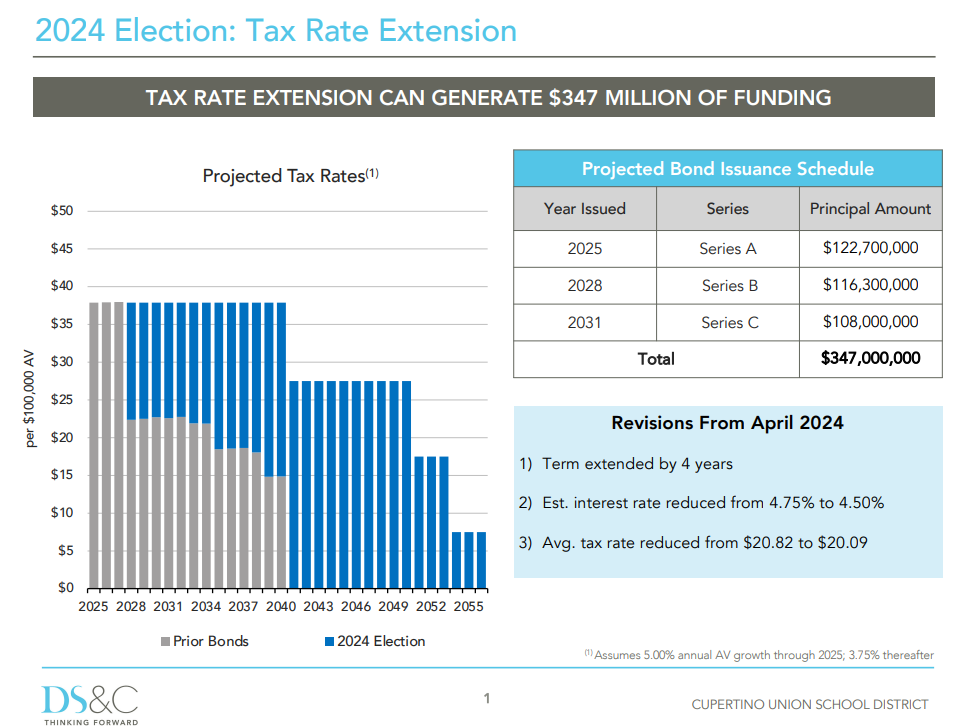

On 06/13/2024, the board voted to put modified tax rate extension on November ballot. The total bond amount is $347M. The tax rate looks like below with longer term and lower average tax rate.

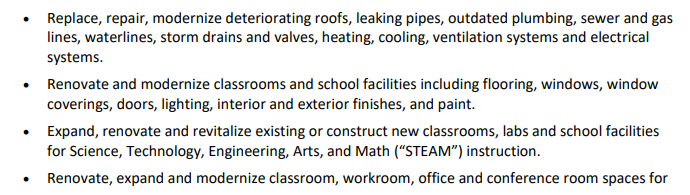

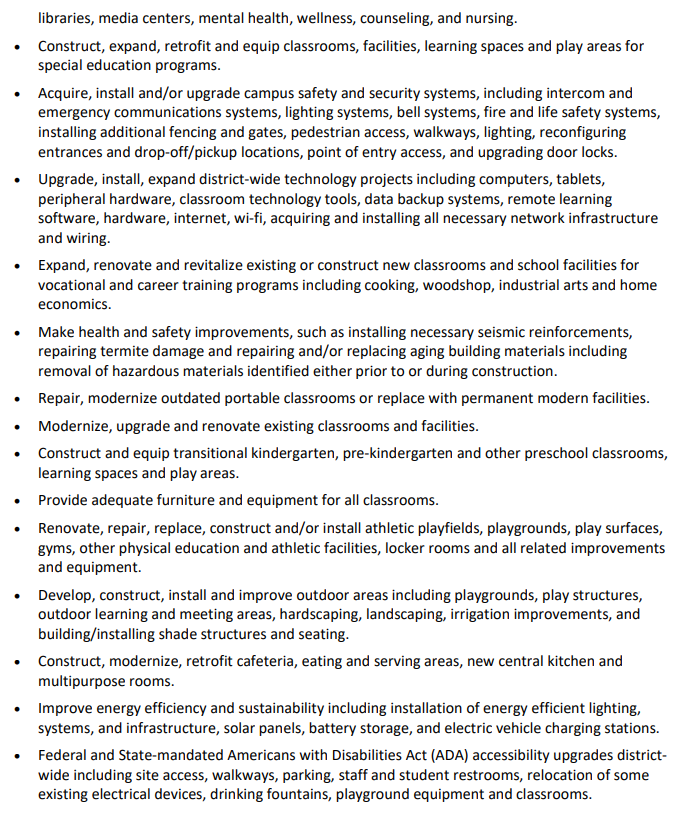

The project list for the bond is mostly generic with emphasis on new classrooms, labs for Science, Technology, Engineering, Art, and Math (STEAM). The keywords for the usage are "repair", "modernize", "renovate", "upgrade", "expand", "construct", etc. Below are the full list.

If passed, the bond will have an oversight committee and report the usage every year.

Scenarios for new bonds (obsolete)

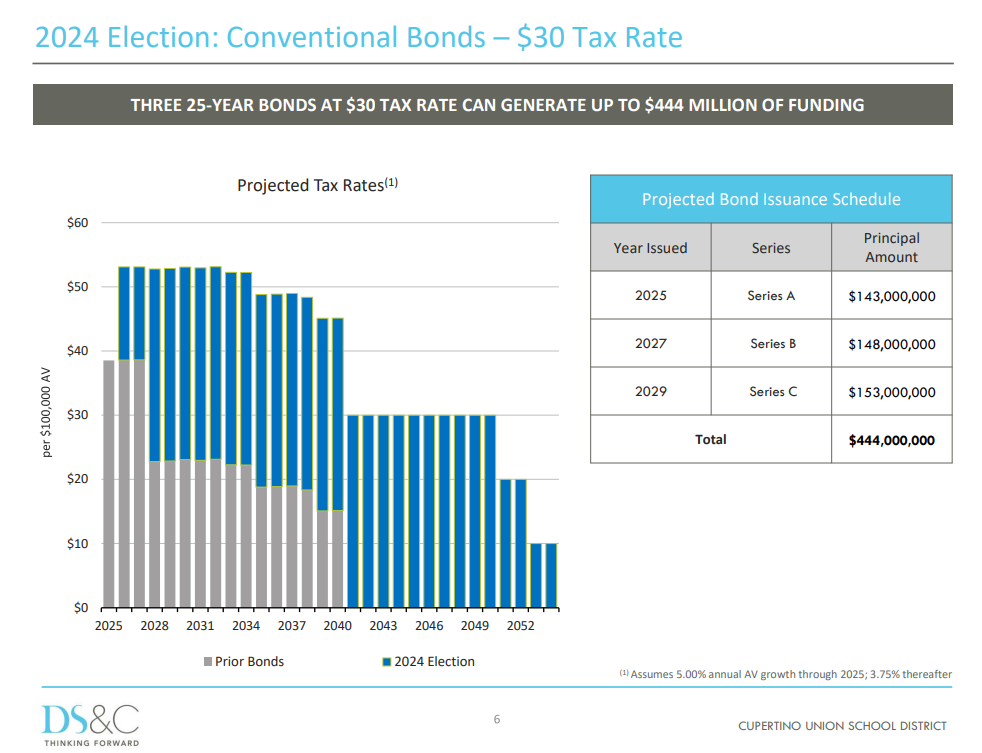

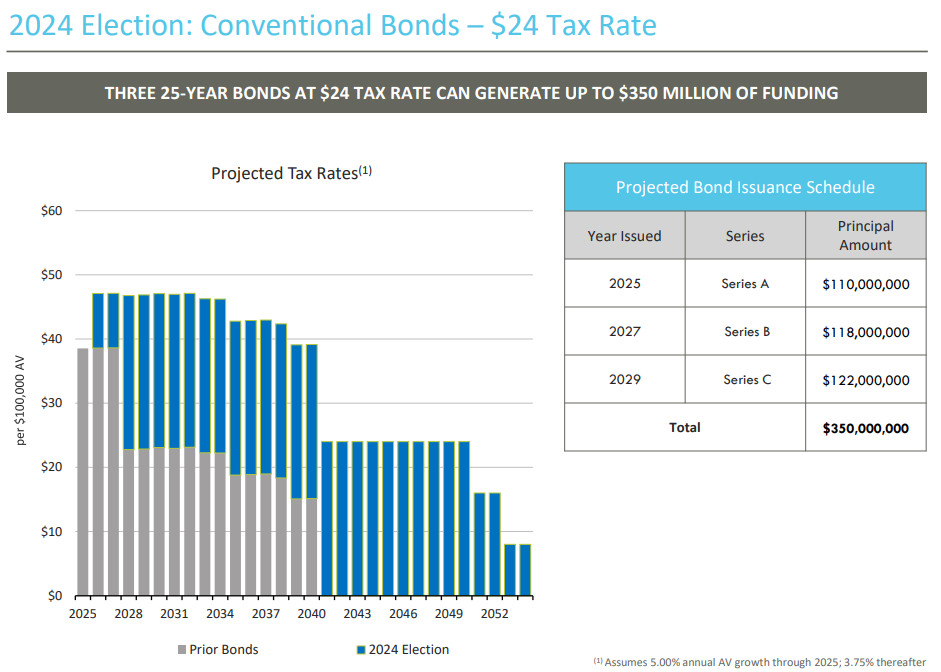

The district proposed three scenarios. Below are the screenshots where you can see residents' burden and the bond amount.

Please notice the tax rate is per $100,000 assessed value (not market value). If you property is assessed to be $2M, your burden for this bond will be 20 times the proposed tax rate per year.

Tax rate: $30 per $100,000 assessed value, total bond value: $444M.

Tax rate: $24 per $100,000 assessed value, total bond value: $350M.

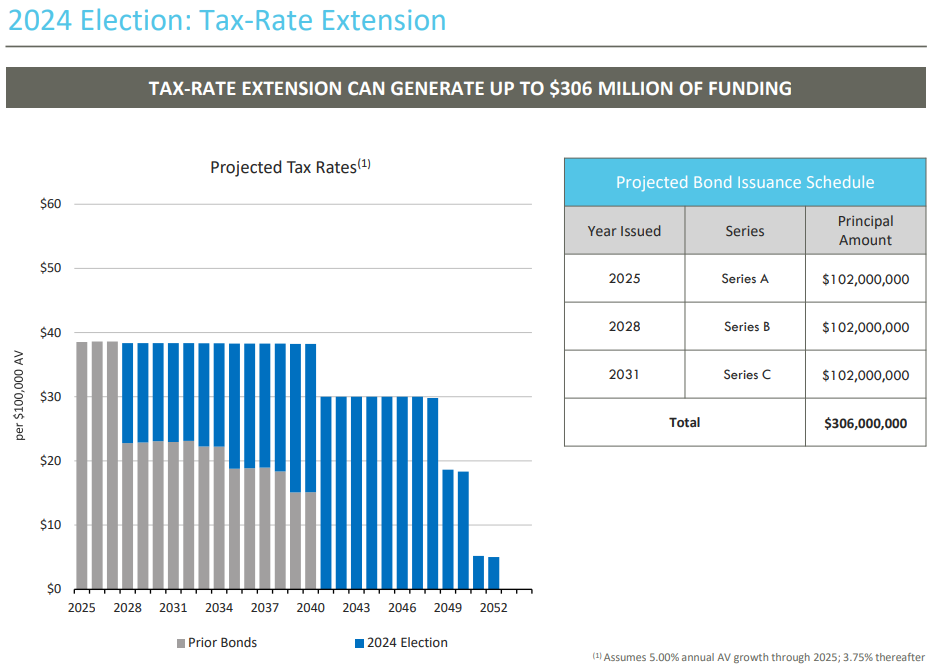

Tax rate extension. Total bond value: $306M.