The debate over how we grade our students is reaching a boiling point in the East Bay. What started as a controversial movement in San Francisco has now arrived in the Tri-Valley—but under a new set of names.

The SFUSD Precedent

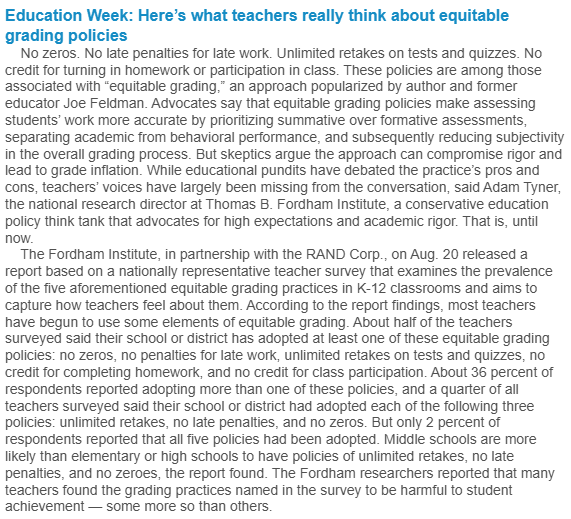

In May 2025, the San Francisco Unified School District (SFUSD) attempted to mandate a district-wide "Grading for Equity" system. The proposal was met with fierce community opposition, leading the Superintendent to pull the plan. Critics argued the system lowered standards and reduced student accountability.

The Tri-Valley Shift (January 2026)

As of January 2026, school districts in Dublin, Livermore, Pleasanton, and San Ramon are actively considering or rolling out similar reforms. However, you won’t find the word “Equity” in many of the new proposals. Instead, administrators are using terms like:

- Standards-Based Grading

- Mastery-Based Assessment

- Grade Reform

The Architect: Joe Feldman

Behind these changes is Joe Feldman, author of Grading for Equity and the consultant who advised SFUSD. While Tri-Valley districts are using his framework, many are taking a "buffet" approach—adopting some of his methods while discarding others that proved too controversial.

For example, due to parent feedback, most local districts have abandoned the "50% minimum floor" (the practice where a student cannot receive lower than a 50%, even for missing work).

What is actually changing?

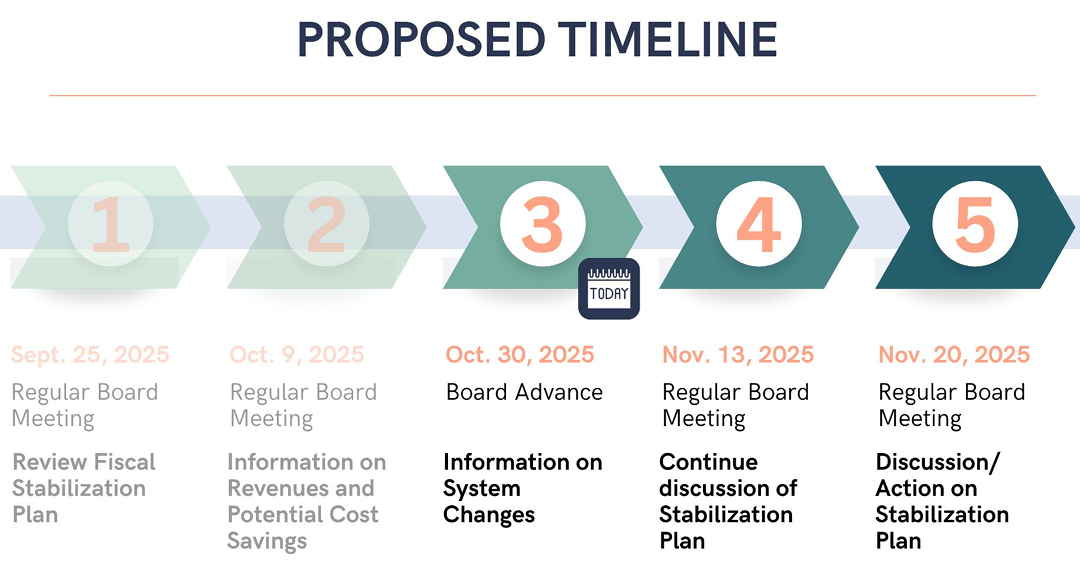

Proposed policies currently under review (including a major vote expected in SRVUSD between February and April 2026) include:

- Eliminating the +/-: An 89% becomes a B; a 91% becomes an A. This aims for "consistency" but has sparked debate among students worried about GPA impact.

- Redos and Retakes: Providing multiple opportunities for students to demonstrate mastery of a subject.

- Separating Behavior from Academics: Eliminating "participation points" or "extra credit" for bringing in classroom supplies, ensuring the grade reflects only what the student has learned.

- Softening Deadlines: Encouraging teachers to reduce or eliminate point deductions for late work.

Why the Rebrand?

Officials state that terms like "Mastery-Based" better describe the goal: ensuring every student actually learns the material. Critics, however, argue that "Mastering-Based" is simply a rebranding of "Equity Grading" designed to bypass the same community pushback that happened in San Francisco.

What do you think?

Does removing the +/- scale make grading fairer, or does it hurt high-achieving students? Is "Mastery" a better goal than "Accountability"?